Blue Clover’s unique price risk management program allows buyers to convert a floating price contract to a fixed price for forward time periods.

When polypropylene pricing volatility can be removed from your procurement, the benefits include purchasing below budget estimates, accurately forecasting future resin spend and potentially enhanced profit margin.

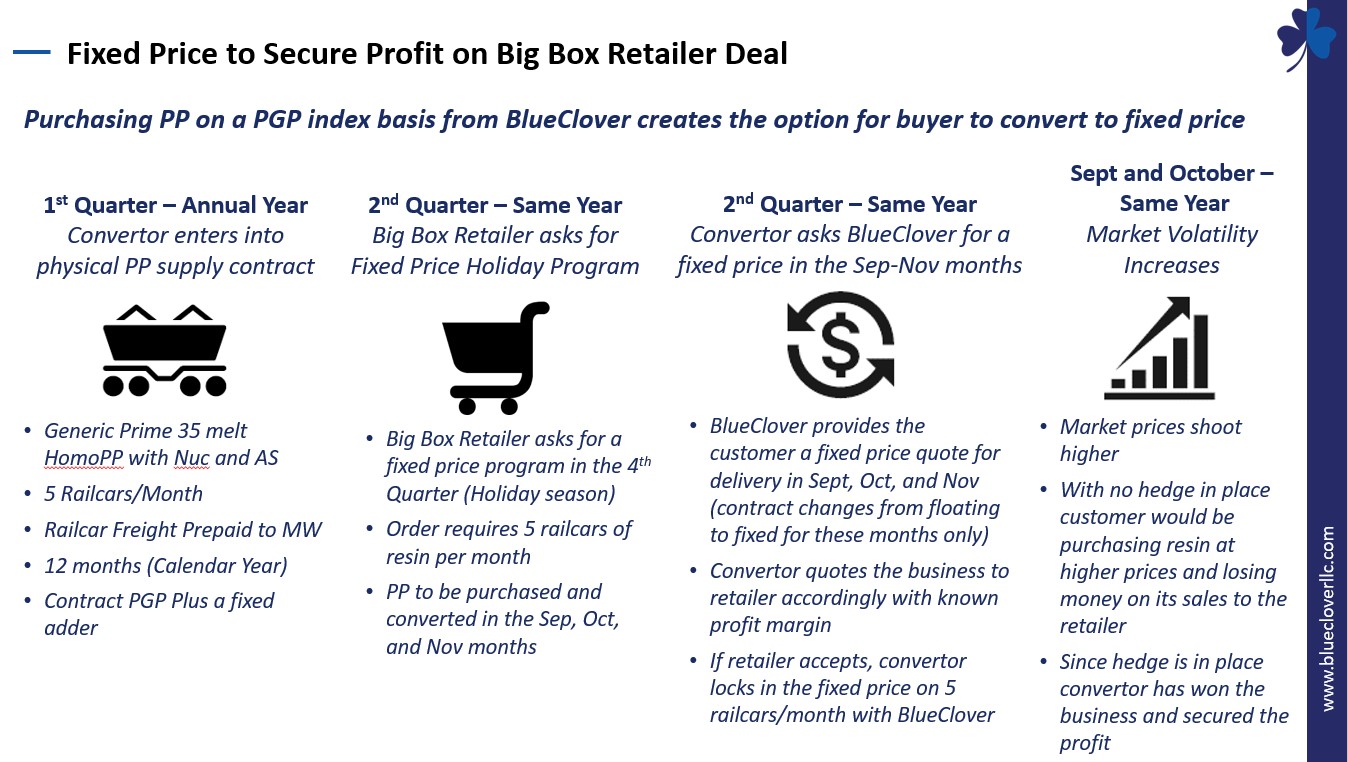

We work with our customers to determine where to place their procurement needs within spot, contract floating, and contract fixed pricing verticals. See below of an example of a convertor that utilizes price risk management to quote a future holiday program to a big box retailer:

Gerard Selvaggio explains why you need hedging in your toolbox!